3 Trends Affecting Chinese Attitudes Towards Imported Food

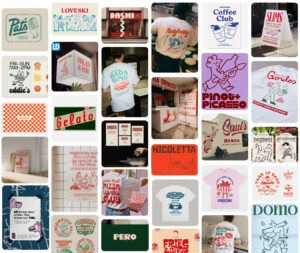

The New Old: 1950s & 60s Revival in Food & Beverage Design

“Eating healthy is more essential these days” is the consensus amongst participants according to recent Thread insights. Great news for imported food brands in China? It turns out that it’s not that simple…

It’s no secret that the availability and ability to purchase imported food products in China has seen rapid increases since the country’s open door policy began all the way back in the late 70s, and the subsequent emergence of the middle classes (total spending on imported food is set to reach $79 billion in 2018).

Consumption of imported food has now become a necessity for many, and it’s unsurprising, given the multiple food scares that have made locally produced food infamous (glow-in-the-dark pork anyone!?).

However – according to a recent YouGov China poll conducted in partnership with us at Thread Design Shanghai – attitudes towards locally produced food products could be changing. Here we look at 3 recent trends that could provide insight into why this is happening.

1. A resurgence of national pride

‘Made in China’ doesn’t hold the same meaning as it once did, especially for Chinese consumers, but has the recent surge in national pride – coinciding with Chinese brands’ coming out party on the global stage – now begun to spill over into the food & beverage industries?

From recent data, country-of-origin is now far down the list when it comes to food concerns, with 51% of consumers considering nutrition, then ingredients, as the primary factors affecting purchase decision (above brand reputation and organic labelling).

2. Chinese consumers have fallen in love with health & wellness

The fact that nutrition is such an important concern these days is probably no surprise at all given the recent fitness craze seen on the mainland in recent years, and it would make sense for this to have a knock-on effect regarding attitudes towards food consumption too.

But wait, isn’t China produced food unsafe, why would a social trend towards wellness affect attitudes towards imported products?

The time for Chinese consumers to be unconcerned regarding the safety of locally produced food has surely not yet passed, however it seems that this same concern doesn’t apply to ‘healthy’ food, with further data showing little association in the Chinese consumer’s mind between healthy food and imported food.

Could this be seen as an early warning sign for foreign food exporters, that have relied for so long on China’s obsession with food safety?

3. A more curious consumer

It would make sense that a shift in attitude towards health & wellness could mean more exposure to information regarding healthy living and eating, potentially encouraging consumers to look more closely at food label contents, rely less on origin as a marker of good produce, and try new products as a result.

Indeed, within China the concept of brand loyalty for many industries is only just starting to emerge, however this has not been the case for many traditional Chinese food brands; who, for many years, have benefited from the Chinese consumer prioritising ‘safety’, preferring to stick with well-known brands and relying on family or friend’s recommendations regarding the purchase of new products, but this could also be changing.

Data suggests that that consumers are now more likely to explore and make opinions for themselves when it comes to food; researching new brands, checking nutritional data, and relying less on established family favourites.

The end for foreign food brands?

So does this signal impending doom for foreign food exporters? Unlikely, Chinese consumers are still purchasing billions of RMB worth of imported food every year. Instead, it more likely suggests a maturation of the market in terms of the availability of products and the emergence of a more pragmatic, curious consumer.

What is certain however, is the unrestricted impact that social trends can have over all industries, and the need for brands to adapt. In terms of the recent health & fitness craze, it has influenced everything, from clothing trends to food consumption, as our final data point attests; Australia, famed for its healthy lifestyle, far outdoing its European counterparts, which are well known for some of the more indulgent imports we see on the super market shelves.

All data is sourced from an online poll by YouGov, the global research and data firm that was ranked No.20 in the ‘2016 AMA Gold Top 25 Global Market Research Companies Report. In partnership with Thread Design Shanghai.